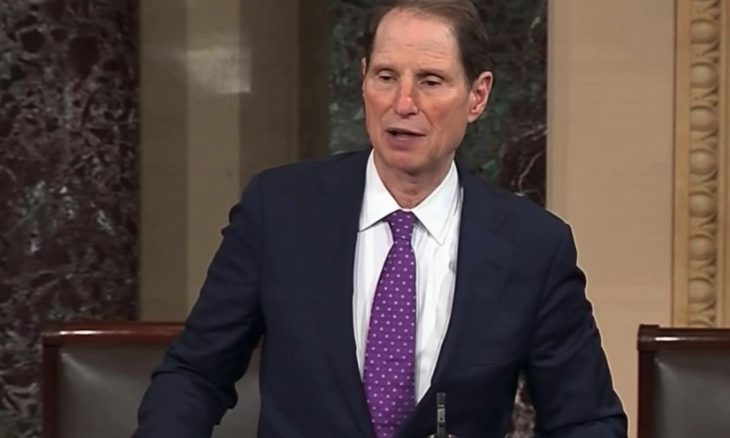

Senator Wyden decries the expense plans acting as legal tax havens for the ultra-wealthy.

The Senate Finance Committee released a report this week after an 18-month investigation into private placement life insurance (PPLI) plans. The findings show that expensive plans function as tax havens for the nation’s ultra-wealthy.

Only 3,000 American citizens are enrolled in a PPLI plan, mainly because the fees and administration costs required for the plans equal millions of dollars in expenditures per year. PPLI plans cover billions of dollars in the “buy, borrow, die” marketing strategy, allowing billionaires to avoid paying taxes on income, gifts, and estates.

Committee Chair Ron Wyden of Oregon stated, “I’m a strong defender of life insurance as a source of financial security for hardworking American families and retirees, but that’s not what’s going on with these tax-dodging private placement policies that are only available to the ultra-wealthy.”

“As is often the case with our tax code and the ultra-wealthy, the scandal here is what’s legal,” Senator Wyden added. “The companies weren’t even trying to hide the fact that their PPLI policies were tax dodges for the very top — that’s precisely how they were promoted.”

As the Lord Leads, Pray with Us…

- For Senator Wyden to be discerning as he evaluates the private placement policies.

- For members of the Senate Finance Committee as they assess the financial dealings and institutions in the nation.

Sources: The Hill, Washington Post